This “how-to” beginner’s guide to buying Cryptocurrency is a great place to start if you’re unsure about how to invest or any of it really…

This “how-to” beginner’s guide to buying Cryptocurrency is a great place to start if you’re unsure about how to invest or any of it really…

This “how-to” beginner’s guide to buying Cryptocurrency article is by the guest author @michael_gironda where you can also contact him to discuss more on this very hot topic.

If you’re tech-savvy enough to know how to type in a URL address and young enough to not be retired on social security, then you’ve probably at least heard of cryptocurrency.

A How-To Beginner’s Guide to Buying Cryptocurrency

But while words like “blockchain” and “bitcoin” have shouldered their way into our modern lexicon, they are perhaps still only understood deeply by a niche community of technophiles and investors.

Here’s my attempt at answering a few commonly asked questions that may help you to form your own opinion on this quickly evolving industry. I’ll start with the King of crypto (at least so far): Bitcoin.

What is Bitcoin and Why is it Important?

Bitcoin, created by the pseudonymously named person (or group), Satoshi Nakamoto, recently celebrated its 12th birthday. It was born from the ashes of the economic crisis of 2008 as a means of putting financial power into the hands of the people, and wresting it from the clutches of banks and corporations.

Its original concept was quite simple: a peer-to-peer payment system that doesn’t require the approval of a middleman (banks).

This is made possible by a revolutionary way of transferring and validating digital information called “Blockchain”, which we may delve into more in a later article.

What sounds innocuous enough at first glance, has grown into a technology that is directly competing with the biggest banks in the world and is supported by an extremely passionate and diverse community that believes it’s time to overhaul the traditional financial system.

What is the Value Proposition of Bitcoin?

Here’s a fact that you won’t easily come across via mainstream sources: 40% of all dollars that have ever existed were printed since the pandemic-induced crash of 2020.

As a result, a government that was already 17 trillion dollars in debt before 2020 has now reached a figure of 28.9 Trillion as of Nov. 2021.

What does this have to do with Bitcoin? Pretty much everything.

Remember – Bitcoin was created to combat the reckless printing and the bailouts that have caused the chaotic economic shift we’ve seen leading up to and after 2008.

Unlike inflationary fiat currencies, Bitcoin has a hard cap of 21 million BTC that will ever be introduced into the crypto economy. Currently, about 90% of those are already in the circulating supply. The remaining 10% will be slowly “mined” until the year 2142, at which point no new bitcoin will ever be introduced.

This makes bitcoin the hardest form of money that has ever existed.

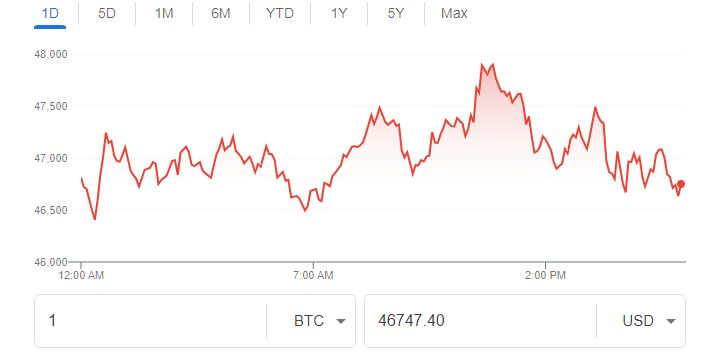

Shortly after its inception, 1 bitcoin could be purchased for ¢6. The infrastructure was severely lacking and security was a wish in your hand, but the idea did catch on. So much so that a mere decade later, one bitcoin will run you about $49,000 at the time of writing.

What is Bitcoin Backed by? It Sounds Like a Ponzi Scheme!

My rebuttal to you is to ask “what is the US dollar is backed by?”

Here in the US, Nixon took us off the gold standard in 1971 and some banks aren’t even required to hold 5% of the dollars they issue!

It is this author’s opinion that a verifiable, hard-capped digital currency like bitcoin instills far more faith than a paper currency that is being inflated into oblivion by politicians with toxic money habits.

OK, But Why Will Bitcoin Continue to Appreciate? It’s Already so Expensive!

The Network Effect being demonstrated in the world of cryptocurrency is unprecedented. Adoption is currently happening at a faster rate than internet adoption in the ’90s, and recent projections have us hitting 3 billion active crypto wallets by 2030. In the world of Bitcoin and crypto, network is everything.

To use me as an example – someone told me about Bitcoin and Ethereum in a coffee shop in 2016. I have since “red-pilled” my entire nuclear family, my fiancé, several co-workers, etc… These people have gone on to tell their friends and families as well. This is a network effect in action.

But that’s just the beginning.

Now institutions, nation-states like El Salvador, and even the old enemy (the banks) have begun to onboard onto crypto.

Simply put – demand is increasing at an astonishing rate while supply is shrinking to its lowest levels in history.

This is economics 101.

How Can I Buy Bitcoin & Other Cryptocurrencies?

Since the early days of cryptocurrency exchanges, the infrastructure has improved dramatically. Thanks to companies like Coinbase, Binance, Robinhood, and PayPal it’s now easier than ever to dip your toe into this new world of investing. And while these companies will custody your coins for you, other companies like Ledger sell devices that allow you to custody your own cryptocurrencies while keeping them safely tucked away in “cold storage”.

I encourage anyone interested to do more research on these options and find the best fit for themselves. At its core, after all, crypto is about taking your financial sovereignty back into your own hands.

What are the Risks?

The major risks associated with crypto can be summed up into 2 categories, in my opinion: Security and Volatility.

Cryptocurrency Security:

As mentioned above, your crypto assets will be stored 100% on the blockchain. This means you won’t have the reassurance of being able to open your safe and touch some physical embodiment of your crypto.

If you choose to store your assets on a centralized exchange, this comes with inherent third-party risk.

If instead, you choose to custody your own crypto, this comes with the risk of losing your passwords and seed phrases and forever losing access to your funds. These things are scary and are admittedly a roadblock for newer and more traditionally-minded investors.

I encourage everyone to do their own research on the methods of safely buying and storing their digital assets.

Cryptocurrency Volatility:

As you may be aware, the crypto market is notoriously volatile. The highs are exhilarating, the lows are soul-crushing.

In fact, at the time of writing this article, bitcoin is down over 15% just this week! This is a common phenomenon in crypto, and unlike the stock market, does not signify a cause for concern.

Such is to be expected when investing in emergent technology.

I like to remind people constantly that investing in internet stocks in the 90s was an equally volatile endeavor. And yet, volatility is what allows the bold investor to earn the massive gains that have become synonymous with taking risks in crypto investing

For the long-term and steady-handed investor, it is this author’s opinion that there is no better risk/reward opportunity than crypto right now. But it is not for the faint of heart! And if you think you’re likely to panic sell when you see your portfolio drop 20% or more, it’s likely that crypto isn’t the right fit for you.

I’ll say only that I have stomached dozens of such dips in the last 5 years and have watched my portfolio gain many multiples as a reward for my patience.

Price Prediction & the Gold vs Bitcoin debate

Finally, the question that I get asked the most: what will bitcoin be worth in the future?

The diplomatic answer is that it depends on your time horizons. In the short term, it will continue to be volatile as we have already discussed.

In the long term, however, it is widely argued by the community that bitcoin will replace gold as the primary ‘store of value’ asset. Bitcoiners argue that BTC is “gold 2.0”, citing that it is more verifiably scarce, more portable, more divisible (one bitcoin can be divided into 100 million satoshis), and more transferrable.

Gold is also losing popularity among younger investors. Millennials in particular are much more likely to convert their cash into digital assets like bitcoin and other cryptocurrencies than gold. It’s morbid to mention, but bitcoiners are multiplying while gold-bugs are a dying breed.

The gold as a store of value narrative is also not as valid as it used to be. If you had converted $100 into gold 10 years ago, you would have roughly $100 today. Gold has therefore not even outpaced inflation.

By contrast, $100 in bitcoin ten years ago would make you a multi-millionaire today.

And while it is unrealistic to expect bitcoin to achieve that same level of growth, Bitcoin advocates believe it is very realistic to assume that bitcoin will equal gold’s market cap value within this decade.

If they’re right, that would make 1 BTC worth between $350,000 – $500,000 by 2030.

Not a bad return if you can handle the price swings.

All that said – time is the great equalizer and only time will tell who is right and wrong on the multitude of hotly contested economic debates. The rise of bitcoin and cryptocurrency will be fascinating to watch, and I for one do not intend to watch from the sidelines.

This has been my brief introduction to the world of crypto, but I’ve barely scratched the surface. If you liked this article and want more perspective on the world of NFTs, altcoins, crypto gaming, and metaverse – let me know!

Or if you simply want to chat about crypto, or tell me I’m an idiot, you can find me on Twitter @michael_gironda

Until then,

keep calm and stack sats!

What would you recommend in a “how-to” beginner’s guide to buying or investing in Cryptocurrency?

Let us know in the comments of our Facebook Hobby Group, or our new Discord server, and make sure you enter the latest monthly giveaway for FREE today!

Get ad-free access videos, a monthly crate of miniatures, and support some of the best creators out there for as little as $6 a month on Patreon!