Buckle up buttercup, Games Workshop’s annual financials are out. This report is perhaps the most revealing one in recent memory, come see how GW is doing!

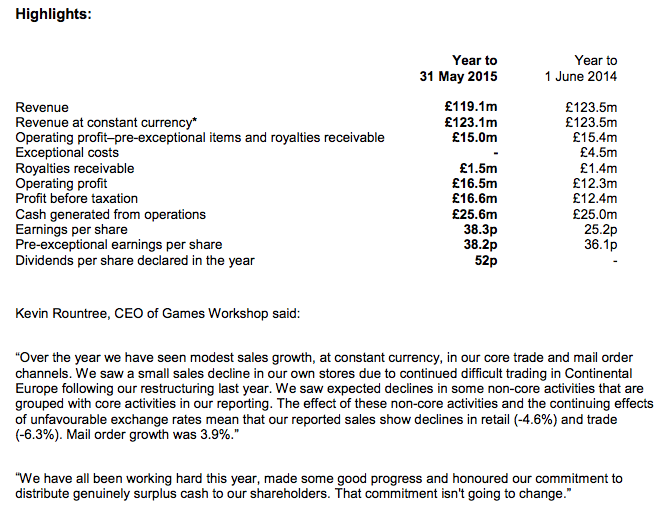

Some top level numbers: (2015 vs 2015)

Revenue: -4%

Operating Profit (pre exceptional items & royalties) -3%

Operating Profit +25%

Earnings per share: +51%

Sales Channel Reports:

Retail: -4.6%

Trade Sales: -6.3%

Mail-order (web store): +3.9%

Excerpts from the CEO:

“Our customers tend to be teenage boys and male adults with some spare money to spend and time to enjoy hobbies. I’d like to think our Hobby – modelling, painting, collecting, gaming – is for anyone. Our customers are found everywhere. Our job is to, on a day to day basis, find them, commercially, wherever they are.”

“We seek out our customers all over the world. We believe that our customers carry our Hobby gene and to find them we apply our tried and tested approach of recruiting customers in our own stores, by offering a fantastic customer experience.”

“Mail order – the mail order store allows enthusiasts full access to all Games Workshop products. It is run centrally from Nottingham. It accounted for 21% of total sales in 2014/15.”

“We have taken the decision in the year to rebrand our stores ‘Warhammer’. It is what our customers call us. This will be rolled out progressively, as and when we open new or refurbish our existing stores. At the year end date we had 13 Warhammer branded stores.”

“In the period we signed 17 new deals and have 44 contracts currently in place to produce more than 50 interactive products. Reported income is split: 52% traditional PC games, 27% mobile and 21% card, board and role-playing game licences. 37 new products were released in the period. We also announced a major tie up with SEGA to develop a real time strategy game ‘Total War: Warhammer’.”

“I will review our product range. We believe this is long overdue: it is time for a resetting of the ranges. Not tweaking here and there but a top down reassessment. I expect to update you further at the half year. We will aim to continue to deliver outstanding product and customer service, maintain our Group gross margin and continue to improve our Group stock turn. To be absolutely clear I will not be reducing the RRP of our products: they are premium priced for their premium quality. I will, however, be looking to offer a broader range of price points.”

I keep re-reading this thing and seeing more and more items that I think are super relevant to the current state of the Table Top industry. Looks for more on this soon!

Games Workshop Financial Roundup

~What’s your take?