Are things looking more on the up from Games Workshop? Check out the details on their annual sales, the hobby, and the 2018 sales road ahead!

Things look to be going much better this year for the toy maker from Nottingham, as they just released this trading update recently.

Following on from the Group’s update on 9 January 2018, the good growth trends have continued to the end of January. Sales and, given the high operational gearing of the business, profits for 2017/18 to date are therefore slightly above expectations.

A great way to turn Dollars To Pounds?

Games Workshop also announces that the Board has today declared a dividend of 35 pence per share. This will be paid on 23 March 2018 for shareholders on the register at 16 February 2018, with an ex-dividend date of 15 February 2018. The last date for elections for the dividend re-investment plan is 2 March 2018.

How do you think sales will go this upcoming period based on what we know is in the release chute? We also recently got a look at their half-year financial report for 2017.

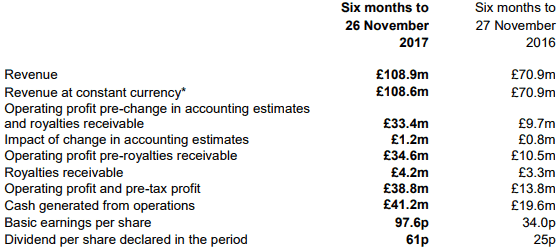

Games Workshop Group PLC (“Games Workshop” or the “Group”) announces its half-yearly results for the six months to 26 November 2017.

Kevin Rountree, CEO of Games Workshop, said:

“Our business and our Warhammer Hobby are in great shape.

We are pleased to report record sales and profit levels in the period. It is encouraging that sales and

profit growth continue across all regions and channels. Given the high levels of operational gearing

and our relentless management of our costs, our improving sales performance has translated into

record profit and cash levels.

Our sales for the month of December have also shown good growth trends.”Risks and uncertainties

The board has overall responsibility for ensuring risk is appropriately managed across the Group. As discussed in the 2017 annual report, the top five risks to the Group are reviewed at each board meeting. The risks are rated as to their business impact and their likelihood of occurring. In addition, the Group has a disaster recovery plan to ensure ongoing operations are maintained. The principal risks for the balance of the year are the same as those identified in the 2017 annual report and are

discussed below:ERP change – we are changing our core ERP system in the UK. This is a complicated project with the risk of widespread business disruption if it is not implemented well. Our new Global Head of IT and her team are making steady progress.

Store manager recruitment – this comprises both recruitment of managers for new stores as well as replacing poor performing managers. Retail is our primary method of recruiting new customers and so we need great managers in all our stores. Our new recruiting website and tools are on track to go live in 2018.

Supply chain – our new mail order warehouse system went live in September 2017. This is part of an ongoing programme of continuous improvement for our warehouse systems. We have strengthened the team with a new Global Head of Logistics joining us in January 2018. In relation to factory capacity, given the step change in our performance in the last two years we need to ensure we have the appropriate infrastructure to support the new levels of product volumes in our vertically integrated

business. We are making the necessary and appropriate investments in factory capacity to manage these risks.

Range management – we are reviewing our range to ensure that we are exploring all opportunities. The risk is that we don’t fully exploit all the opportunities that are available to us. We have strengthened the team and a new Global Head of Merchandising will be joining us in February 2018. Distractions – this is anything else that gets in the way of us delivering our goals. Games Workshop relies upon the continued availability and integrity of its IT systems. Our business

critical systems are monitored and disaster recovery plans are in place and reviewed to ensure they remain up to date. The security of our systems is reviewed with software updates applied and equipment updated as required.

We do not consider that we have material solvency or liquidity risks. We also feel that it is too early to tell what the effects will be on Games Workshop of the UK Government invoking Article 50 of the Treaty of Lisbon, notifying the European Council of its intention to withdraw from the European Union.

The greatest risk is the same one that we repeat each year, namely, management. So long as we have great people we will be fine. Problems will arise if the board allows egos and private agendas to rule. I will do my utmost to ensure that this does not happen.

But, you can’t have a reward without a little bit of risk. Games Workshop’s biggest concerns right now are implementing a new Enterprise Resource Planning (ERP) program, kicking off a new website for store manager recruiting, increasing factory capacity, and making sure they are exploring all opportunities to increase the range of their products. But they were pleased to announce that they do not believe they have material solvency or liquidity risks.

All in all this report gives us a great idea of how Games Workshop is doing as a whole, and the future of our beloved hobby looks brighter than ever, and investors are going to be getting a nice dividend of 35 pence per share.

What are your thoughts on the latest half-year financial report? Are you happy to see Games Workshop is still paying out dividends? Let us know in the comments below.