We can probably all agree it has been a slower six months (compared to last year) for the model makers from Nottingham. Games Workshop has released its trading update for its half-year 2021 sales and revenue, and it’s pretty interesting.

Overall sales and profits are actually down compared to last year, but they predicted this a few months ago. However, if you’re an investor, the good thing is, your dividends are increasing from last year. Let’s first compare the financials, and then get into the reasons why profits are down, but why things might be looking up for the future.

Games Workshop CEO Announces Sluggish Profits & More for 20211

Source Games Workshop & CEO Kevin Roundtree

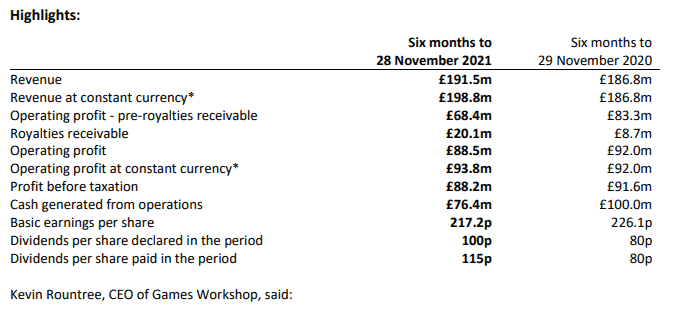

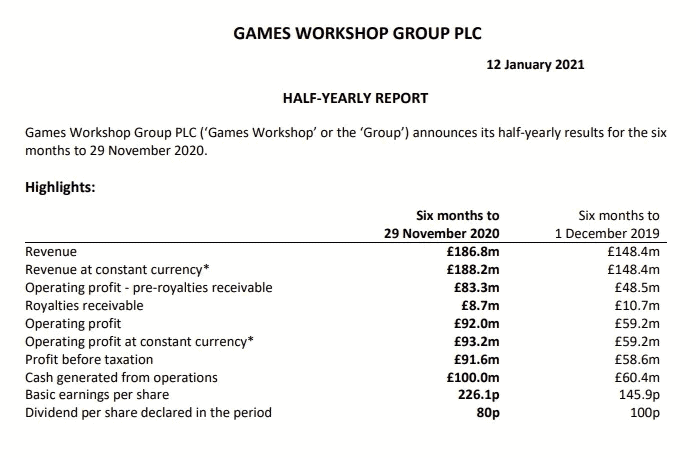

Basically, there was a lot more overhead this time around. Again, the one good thing for investors is that dividends grew a lot considering how the revenue went.

Let’s check out some highlights from the year.

Highlights of the Games Workshop Half-Yearly Report 2021

- Warhammer + 2 million views in total across all shows in just three months.

Just a little apples-to-apples metric here. Spikey Bits video views in the same period were about roughly 540,000 or 25% of the views of Warhammer+ Plus.

- increase in sales same period last year versus this year.

So while the growth was sluggish, it did still increase.

- The new system and technology in our Memphis facility are now operational, significantly increasing the number of orders we can pick and pack. The £5 million of backorders at the end of November 2021 will be cleared by early January, hurray!

This is good, we just wish they didn’t do it in the middle of the holiday season which created huge problems. Still, it’s better to have the robots in the warehouse, than not from what it seems.

- Licensing income Royalties receivable in the period increased by £11.4 million to £20.1 million. This includes £13.7 million (2020: £2.3 million) of guaranteed royalty income which is recognized on the signing of new license contracts, while additional royalty income earned was equal to the prior period at £6.4 million.

As we said, this was their main increase for the year and kept the profits afloat.

- Cost to sales ratio – at 29% (excluding group profit share) (2020: 28%) our costs are under control and mainly relate to increases in staff costs (3% annual pay rise and increases in headcount +27).

Anything under 30% is really good, but the number is increasing and getting close to that mark.

- Online sales declined by 10% compared to the same period last year, maintaining the step change in sales order levels against the prior year is the plan.

This could be COVID-related, or it could be people voting with their hobby dollars more in the latter half of 2021. We don’t know a hundred percent either way. But it does seem to follow retail trends as people got back out into the swing of things starting in summer.

- Our profit before tax is down £3.4 million (note change in sales growth same period last year please ’19-’20).

Their growth the previous year was so insane, we almost can’t expect it to always grow like that, however as we mentioned about revenue would have been flat or negative if it was for an increase in licensing. Roundtree also later on in his report mentioned licensing revenue as “uncertain”.

That’s of course non-withstanding the potential lower engagement level among hobbyists in general that Games Workshop seems to either be ignoring or are unaware of in their official reporting.

After polling stores worldwide, we expect a general decline in revenue overall starting with these numbers.

Here are more articles on the issues that Games Workshop is facing now as their stock has dipped and investors have taken notice:

- What the Community Thinks About the New 40k Rules Updates

- Is Warhammer+ Plus Worth It: Everything You Need To Know

- Games Workshop NDA Leak More Damaging Than Their IP Policy

- YouTubers Have Started Attacking Warhammer TV

- Boycotts Don’t Work, Do This Instead to Games Workshop

- Lookout YouTube, GW Just Updated Their IP Guidelines

- Where GW Fan Creativity Ends & IP Infringement Starts

Why do you think Games Workshop has seen sluggish profits and revenue in 2021?

Let us know in the comments of our Facebook Hobby Group, or our new Discord server, and make sure you enter the latest monthly giveaway for FREE today!

Get ad-free access to our videos, a monthly drop of miniatures, and support some of the best creators out there for as little as $6 a month on Patreon!