Games Workshop faces a shareholder revolt over the board’s pay and lack of a dividend, as investors have rejected vital resolutions.

What Sparked the Shareholder Backlash?

Imagine you’re a loyal shareholder. You love the company; you love the lore (or maybe just the dividends.) Then you notice your favorite game’s CEO, Kevin Rountree, is now earning close to three times what he made just four years ago. Not bad, right? Unlike last year’s hefty payout, there’s no new massive surprise dividend this year to sweeten the deal for you. For nearly 25% of the shareholders, this may have felt like a power move from the board while their wallets stayed the same.

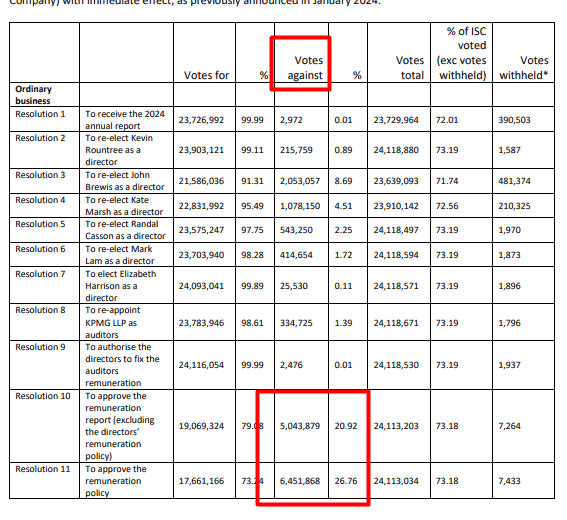

Summary of the 2024 AGM Voting Results

At the 2024 AGM, shareholders were given the chance to vote on resolutions, including two particularly spicy ones, Resolutions 10 and 11. The problem? We don’t actually know what they were about specifically (because nothing’s ever that simple). However, when almost a quarter of your shareholders object to something, you might want to pay attention. The board said they’d “check in” on the matter in about six months. Sounds like a long cooldown, doesn’t it?

Let’s face it—when people see the phrase “executive pay hike,” it tends to stir feelings. And when that increase more than doubles the salary of key figures in the company (not to mention even higher jumps for non-executive directors), shareholders begin to question the fairness of the power balance.

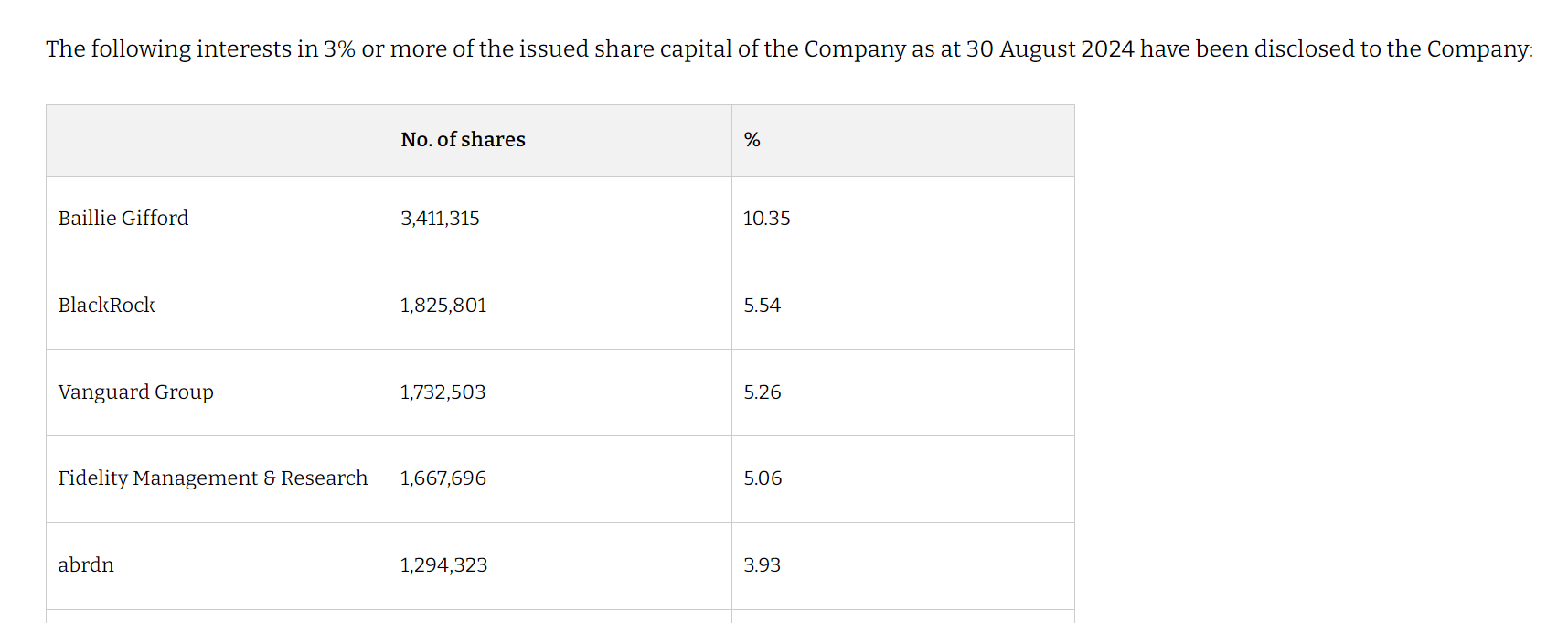

The Role of Major Institutional Investors (Fidelity, Vanguard, BlackRock)

Financial titans. Fidelity, Vanguard, BlackRock—names that could almost be mistaken for rival factions in a new Warhammer expansion. These big players control vast chunks of shares, and they’re not the type to be amused by excessive pay hikes without corresponding gains. When institutions this large feel their investments aren’t being properly managed, even Space Marines couldn’t save you from the incoming pushback.

Kevin Rountree’s Salary: A Significant Jump Since 2020

Speaking of big moves on the battlefield, Kevin Rountree has been leveling up faster than an overfed Tyranid. Back in 2020, Rountree’s base salary was around £700,000. By 2024, he’s knocking on the door of £2 million annually. That’s quite the pay rise—especially when you add another £2 million in stock at his disposal. It’s the kind of reward you’d expect after single-handedly slaying a dragon (or managing a tabletop empire). But in the eyes of some, this rate of salary increase may seem like a special character in the rulebook getting too many overpowered abilities at once.

CEO Compensation Tripled in 4 Years

Rountree’s income has tripled in four short years. That’s right—threefold in the time it takes for a typical Warhammer edition to come and go. When you see a leap like that, eyebrows tend to raise faster than the point costs in a new codex. While Games Workshop has undoubtedly been successful, some shareholders might be wondering if it’s necessary for the CEO’s pay to inflate quite so aggressively, especially when dividends don’t seem to be flying in as frequently as some would hope.

Rountree’s £2 million package includes his base salary, bonuses, and a little something extra in stock awards. Bonuses doubled between 2020 and 2021 when the latest remuneration policy was given the green light. With his base salary and bonuses alone, the man is pulling in enough to buy more than a few Battleforces every year (and maybe even have some extra for Forgeworld minis).

Impact of the Remuneration Policy Approved in 2021

That brings us to the 2021 remuneration policy—the mystical document that opened the vaults of the empire for Rountree and the board of directors. This policy essentially sets the guidelines for how executives get paid, and once approved, it led to significant salary increases. While it clearly worked for some (looking at you, Rountree), a growing group of shareholders seem to be questioning if it went too far. Perhaps the salary buffs have become a little unbalanced, and like any game, a rebalance might be in order.

Non-Executive Director Pay: A Fourfold Increase

Take non-executive director John Richard Allistair Brewis, for instance. His pay has jumped from a modest £50,000 to a whopping £200,000. That’s four times the amount in just a few years! This isn’t a case of modest inflation adjustments—this is like promoting a single guardsman straight to Chapter Master. Unsurprisingly, this has ruffled more than a few feathers among shareholders.

The rest of the board isn’t missing out either. Many of them have seen increases of 20-40%, making 2024 the year of financial gains—at least for those in the upper echelons. For shareholders, who might have expected this year to be more conservative given the absence of last year’s dividend, these increases seem to stand in stark contrast to what was actually delivered in financial results.

So, why exactly are shareholders so agitated? It isn’t just the oversized paychecks—there’s a broader sense of dissatisfaction bubbling under the surface. After all, when you’re accustomed to regular dividends and profits, you start to ask questions when those things suddenly dry up, and the board is walking around in golden armor.

Lack of Transparency: What Exactly Did the Shareholders Reject?

The frustrating thing for many is that no one really knows what specific part of the remuneration policy has ticked everyone off. Sure, Resolutions 10 and 11 at the AGM were rejected by about a quarter of voters, but without a clear breakdown of what those resolutions covered, it’s like trying to guess the outcome of a battle without knowing which armies are involved.

If you’re wondering what Resolutions 10 and 11 were all about, join the club. Games Workshop has kept the content of these resolutions under wraps, leaving everyone on the outside speculating. Given the backlash, it’s safe to assume they had something to do with those ever-inflating paychecks that have doubled and even tripled for some since the last policy was voted into place. There are lots of theories with no specifics, but there are no real answers.

Massive Salary Increases Amid Flat Financial Performance

One of the main gripes from shareholders may be that spectacular financial results aren’t exactly backing up these salary increases. It’s one thing to reward executives when the company is raking in profits, but Games Workshop’s latest performance? Well, it’s been more in line with expectations than anything earth-shattering.

2024 Trading Update: In Line with Expectations, But No Dividend

In September 2024, Games Workshop gave its quarterly trading update, and let’s say it wasn’t the showstopper everyone was hoping for. The board essentially said, “Hey, we did about what we expected,” which, while acceptable, isn’t exactly cause for a celebration. Here’s the kicker: no extra dividend announcement. That’s right—no surprise “we made more money than expected” dividend like in 2023. For shareholders hoping for a repeat of last year’s bumper payout, this news may have feel flat.

And no wonder, Games Workshop’s earnings did average, with a terrible Skaventide release, New product previews canceled across the board, and months between 40k releases, hobbyists don’t seem to be as engaged as they were.

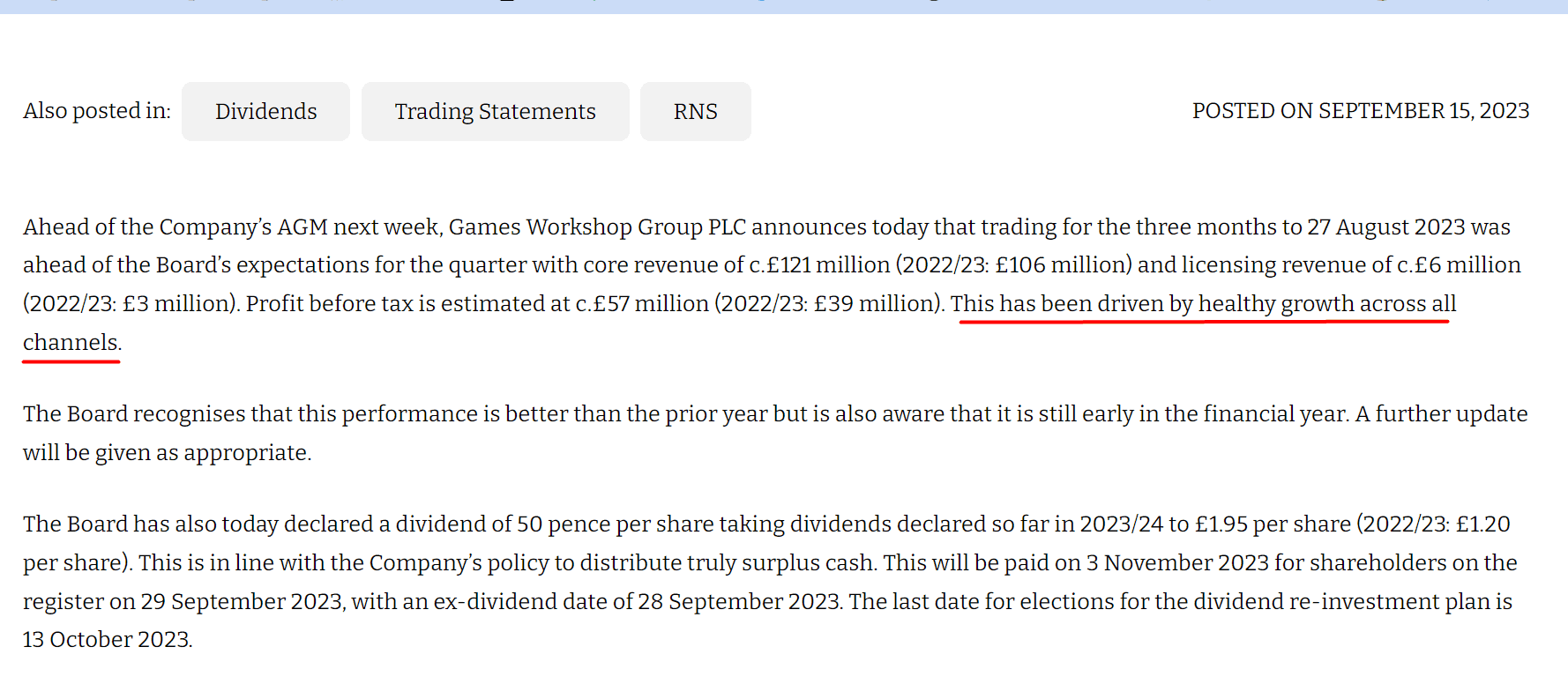

Comparison to 2023: Surpassing Expectations and Announcing Dividends

Let’s rewind to 2023. Games Workshop wasn’t just meeting expectations; it was smashing them. They declared a 50p dividend, and shareholders were ready to paint the town red, Blood Angels Red that is. But in 2024, with no surprise windfall and an uninspiring performance, it’s no wonder the lack of a dividend may be stinging a bit more than usual.

Frustration with Dividend Policy

Shareholders may have been, quite frankly, miffed. Games Workshop has a policy of paying dividends when there’s surplus cash. It’s a simple rule that investors had come to love, like a reliable tech-priest always ready with a repair protocol. But this year, the board’s response seemed to be: “Well, we did okay, but no extra cash for you.” That leaves shareholders wondering if the surplus cash ended up in the pockets of the executives instead.

Why No “Surplus Cash” Dividend Like Last Year?

It’s the question on everyone’s mind. If 2023 saw a whopping dividend and 2024’s performance wasn’t catastrophic, why no similar payout? For many shareholders, it may feel like the board is pulling a sneaky maneuver here—paying themselves handsomely while keeping the profits from being shared with those who actually own the company. It’s a bit like watching your favorite Chapter Master keep all the loot for themselves after a glorious battle.

When you’ve got investors like Fidelity, Vanguard, and BlackRock on your cap table, the stakes are high. These are institutional shareholders with a huge influence on how the company is run. If they’re not happy with the current state of affairs, changes are bound to come.

These institutional powerhouses aren’t just holding a few shares—they collectively own big chunks of Games Workshop. If they decide the board is heading in the wrong direction, they’ve got the voting power to start shaking things up. For a company that prides itself on its careful strategy and long-term vision, this might feel like a squad of Terminators landing right in the boardroom.

The Impact of Concentrated Ownership on Board Decisions

With so much power in the hands of these institutional shareholders, the board can’t just ignore them. If they’re upset over pay hikes, dividend policies, or lack of transparency, the board might be forced to rethink some decisions. When the big boys start asking questions, the board has no choice but to answer—probably with fewer luxurious pay packages next time.

How Funds and Firms Are Responding to the Pay Hikes

It’s hard to say exactly how Fidelity, Vanguard, and BlackRock feel about the executive pay increases, but the fact that nearly 25% of shareholders rebelled gives a pretty strong clue. These institutional investors aren’t known for tolerating unnecessary extravagance, especially when the company’s financial performance isn’t smashing expectations. Their response could be anything from a stern word at the next AGM to actively pushing for new board members more aligned with shareholder interests.

What’s Next for Games Workshop?

The Board’s Response to Shareholder Concerns

So far, the board has promised to look into why shareholders are upset and report back in six months. It’s a bit like getting a cliffhanger ending in a Black Library novel. Will they scale back the pay hikes? Reintroduce surprise dividends? The response could shape Games Workshop’s relationship with investors for years to come.

One thing’s for sure: this isn’t the last we’ll hear about executive pay at Games Workshop. If the current pay structure continues to cause unrest, there could be reforms on the horizon. The company might have to think twice before handing out another round of hefty raises while keeping shareholders on the financial backburner.

Timeline: Follow-Up Report Promised in Six Months

The board has promised to revisit the shareholder revolt in six months. That’s practically an eternity in the world of business, but it gives everyone time to cool off and for the board to figure out their next move. Until then, the shareholders will be watching closely, waiting for a sign that their concerns are being taken seriously.

Conclusion

Whether it’s adjusting the remuneration policy, delivering on dividends, or just keeping everyone on the same page, the board will have to strategize carefully if they want to avoid another uprising. After all, no one likes to be on the losing side of a battle.

All the Latest Warhammer Rules & Model Rumors

What do you think about the raises and the 25% dissenting vote that seems to indicate an issue with the board’s pay rate?