While Games Workshop’s stock climbs with strong mid-year profits under CEO Kevin Rountree, fans and stores question the company’s continued inability to keep up with product demand.

In the grim darkness of mid-year financial reports, there is only… profit? Games Workshop, the powerhouse behind Warhammer 40,000 and Age of Sigmar, has dropped a financial update that would make an Administratum scribe proud. The numbers are impressive, with revenue and profits surging faster than a Tau battlesuit on overdrive.

But while the Imperium’s coffers overflow, the hive cities of local game stores and hobbyists tell a different story—a mix of grumbling and confusion about missing stock, questionable value in key products, and a general sense of disconnect.

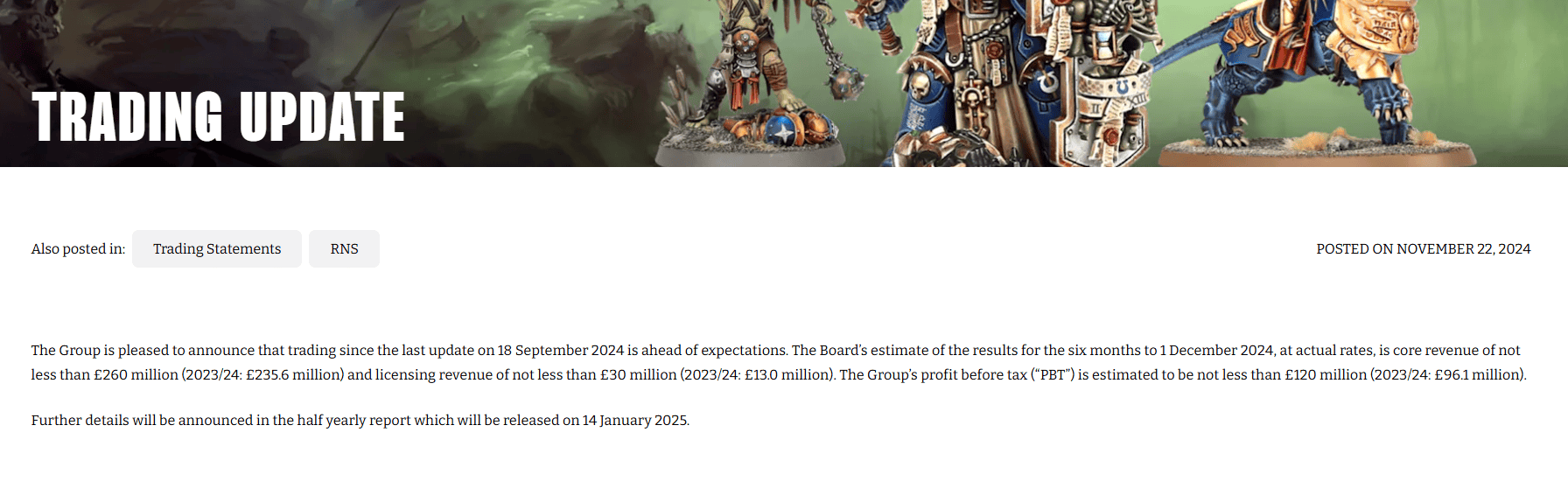

This comes after the wild dividend payouts that felt like making peace with ‘revolting’ shareholders (like Blackrock). The company’s recent financials for the mid-year are quite strong, especially after reporting “in line” sales for the year.

GW Stock & Financials: A Tale of Triumphs, Trials, and Tactical Misses

Yet, behind the numbers lies a story of victories, missteps, and the curious interplay between corporate priorities and community engagement.

The Numbers Look Stronger Than a Custodes Shield Captain

These figures indicate a solid performance, with much of the growth credited to the launch of Age of Sigmar 4th Edition, contributions from Boarding Actions in 40k, and a significant boost from Space Marine II, the video game that’s seen hobbyists swapping controllers for paintbrushes.

On paper, Games Workshop stock should have plenty to celebrate, as investors often eye robust revenue growth as a positive signal. However, the stock market isn’t just about numbers—it’s also about perception. While the Imperium might be thriving on one front, the local game stores—the frontline troops of the hobby—are struggling with stock shortages and mismatched allocations, leaving both them and customers frustrated.

This post is days old from RIW Hobbies, which is dumping Warhammer products at the busiest time of the year. This is one of dozens of stores we have heard the same from this year alone. Even worse, one major distributor we spoke with said their Games Workshop sales would be down this year for the first time, mind you, by a massive 30%!

Games Workshop Financials Compared to 2023

This announcement came at a high point when GW’s new releases had renewed interest in their product lines, creating an optimistic environment among investors in the run-up to the Amazon partnership announcement.

Why the Street-Level Mood Feels as Grim as the 41st Millennium

The Battleforce Conundrum

Battleforce boxes, typically a smash hit during the holiday season, have had a rough showing this year. Several boxes remain unsold on GW’s website—a rarity for products that usually vanish faster than a Necron Warrior’s soul in Trazyn’s collection. This year’s boxes have faced criticism for higher prices and fewer miniatures, leading some to wonder if GW misjudged the market.

Local game stores, which often rely on these holiday releases to boost engagement, report receiving fewer boxes than requested. The mismatch between supply and demand has left hobbyists frustrated, potentially pushing some toward other games—or simply toward waiting out the current edition.

This is also coupled with the fact people can’t get what they want, think of how long Pariah Nexus cards have been sold out, kits of new models (basically every release comes out, then is out of stock for long months). Not to mention the huge slowdown this year in model releases…

What’s Driving the Financial Success?

They say they expect licensing revenue to double based on last year, but it is unclear whether this is due to Space Marine II or not. The game’s success is not just reflected in royalty revenue—it’s likely helped sell AoS starter sets and 40k army boxes as well. After all, who can resist the call of battle after watching Lieutenant Titus carve through hordes of enemies?

Is AoS Finally Getting the Love It Deserves?

Games Workshop CEO’s Role in Steering the Ship & Stock

Much of GW’s performance, whether celebrated or critiqued, reflects the decisions made by its leadership. The current Games Workshop CEO, Kevin Rountree, has overseen significant expansions into licensing, media, and global market penetration. While these moves have boosted the company’s financial standing, hobbyists have expressed concerns that the focus on investors might be overshadowing the core community experience.

Rountree’s ability to balance shareholder expectations with the needs of players and retailers will likely define his tenure, especially as Games Workshop stock fluctuates in response to these strategic shifts.

The Role of Licensing: Pure Profit Gold

What makes licensing revenue so appealing to GW is its near-total lack of costs. Producing and shipping miniatures comes with expenses, but royalties? That’s straight profit—a real Midas touch in an inflationary environment. With projects like Space Marine II and Amazon’s upcoming Warhammer series in the pipeline, licensing could become GW’s biggest weapon in its financial arsenal.

Fans’ Perception: Profit vs. Passion

This perceived imbalance—profit-driven decisions at the expense of local stores and fan goodwill—could pose long-term risks. Players are the lifeblood of Warhammer, whether they’re building armies for 40k or battling in the Mortal Realms. Alienating this base could eventually erode the community that fuels GW’s success.

So, What’s Next for GW?

- Rebalancing stock allocations to support local game stores better.

- Delivering better value in key product lines, particularly for new players.

- Continuing to capitalize on licensing opportunities, which could offset some of the pressures on their core business.

Final Thoughts: An Unstable Warp Rift For Games Workshop Stock

Games Workshop’s financials may shine brighter than a C’tan shard, but the challenges at the street level can’t be ignored. The company’s ability to balance corporate success with community satisfaction will determine whether it can sustain its current momentum—or whether this success is as fleeting as a Chaos God’s whim.

For now, Games Workshop CEO Kevin Rountree and his team sit at a crossroads: basking in financial triumphs with a possible inclusion into the FTSE (as one of the top 100 businesses in England and becoming a “blue chip stock”) or facing a reality that demands more than just dividends to secure the company’s future. Fans can only hope GW finds a way to align its ambitions with the needs of the hobbyists who make it all possible.

All the Latest Warhammer Rules & Model Rumors

What do you think about the huge Games Workshop stock and profit going up while the community rails? Do you think Games Workshop’s CEO is doing a good job at the helm?