Investor Columnist Richard Beddard is back on Games Workshop’s case after their latest financials. Come see what he has to say about the company in 2016.

Richard Beddard had a lot to say on Friday about GW’s latest financial report, and he made four BIG points about it in his latest weekly column.

His frustration starts as early as page one of their 2015 financials;

Source: Richard Beddard, Interactive Investor Aug 5th 2016

GW: 2016 vs 2015

Revenue: -1%

Operating Profit (pre exceptional items & royalties) -27%

Operating Profit +2%

Earnings per share: +10%

Sales Channel Reports:

Retail: -2%

Trade Sales: +0.001%

Mail-order (web store): -2%

Games Workshop opened 48 new stores and closed 13, lifting the total number by 10%, yet retail sales fell 1.3%

Beddard’s Four Points:

Poor explanations

The firm is committed to returning cash it doesn’t need for investment to shareholders

Ignoring threats

The core customers are modellers who may never play the game.

But I’m not confident about Games Workshop and the reason isn’t, specifically, one of the putative challenges put up by naysayers over the years: (It is the following?):

- the emergence of competing model and game designers,

- videogames,

- the availability of counterfeit models on the Internet,

- or the possibility that in future modellers might print their own miniatures using 3D printers.

Tom Kirby

(Tom Kirby) Is he worth it?

The report gives the impression of a company run ruthlessly from the top down.

Kirby may be worth it – the annual report doesn’t divulge what he does – but his defence of the board is symptomatic of Games Workshop’s communications with stakeholders.

Source of extreme frustration

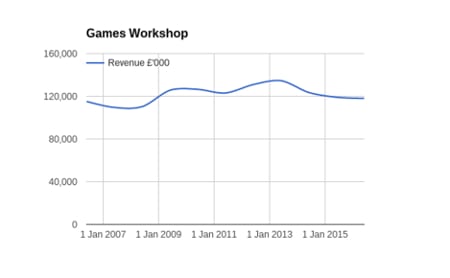

This is the source of my extreme frustration: 2016 was a relatively bad year for the core business, yet Games Workshop is healthy. A share price of just under 490p values the enterprise at just over £200 million, or 13 times adjusted profit (including royalties).

So basically to sum up his whole article Beddard states:

Instinct, though, tells me not to trust the board, not because it’s knowingly dishonest, but because unknowingly it believes its own hyperbole and only really listens to compliant customers, shareholders, and employees.

If it’s on the wrong track, the board’s stubborn insularity is likely to keep it there.

Well after that, how do you as a hobbyist think this conclusion sounds based on what you know of events of the past year? Is Games Workshop moving forward, on the wrong track, or perhaps both?