Games Workshop raked in record profits, but can’t keep up with paint, plastic, or demand; here’s what the numbers say and why it matters to your backlog.

Games Workshop just dropped its annual financial report, and surprise, it’s raining cash again.

Warhammer’s printing money, video games are crushing it, and they’re opening stores like it’s a fast food chain. But beneath the gold-plated numbers and the new logo, there’s some real hobby grease in the gears.

Let’s break it all down without the corporate fluff.

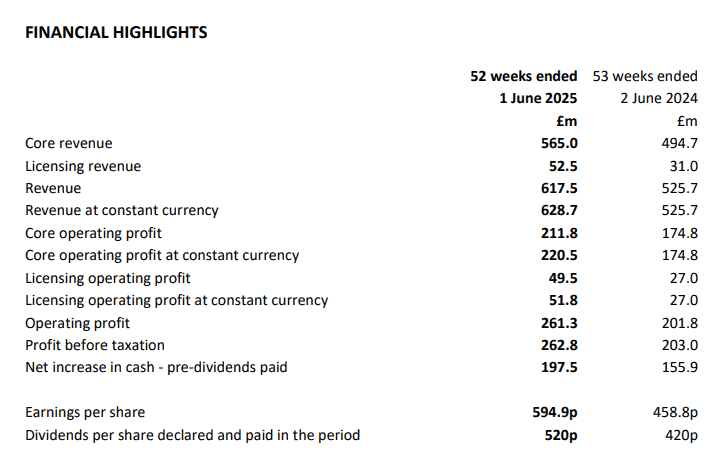

Warhammer Is Printing Money Again

Turns out, when you slap Space Marines on a screen, people open their wallets.

Their profit before tax hit £262.8 million, and their operating margin held strong at 37.5%, which is wild for a company that still sells pewter dragons in some places.

From a business angle? That’s clean, efficient, and wildly profitable.

Space Marine 2 Carried the Banner, and the Cash

They’re still hush-hush on that Amazon Warhammer 40k series (the one with Henry Cavill), but it’s clearly in motion. The licensing team earned its pay this year.

The only catch? GW admits this kind of spike is tough to repeat.

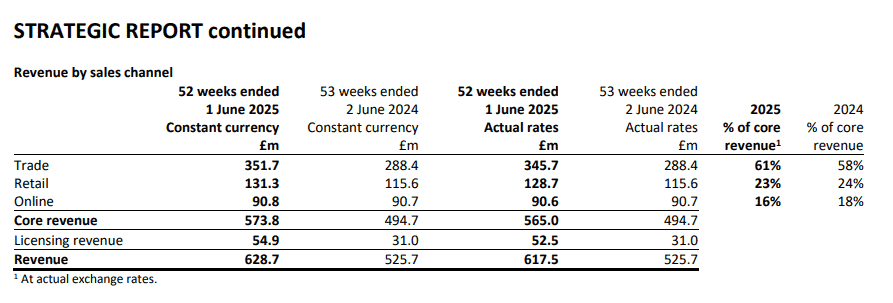

Record Sales, Record Stores, Still No Paint?

But here’s where the wheels start to squeak: they literally can’t keep up with demand.

- They added a third shift and 10 robot pickers in Memphis, TN. Still behind.

- The new paint factory is live. Still behind.

- Forecasting is better. Still not enough product in the right places.

You know what’s worse than a sold-out model? Sold-out paints that you can’t get for months on end. That’s a problem in a hobby where you can’t play without the stuff you’re buying.

It also doesn’t matter how cool the minis look on the Warhammer Community feed if you can’t get them.

Chasing Growth, Ignoring Friction

They’re even going carbon-light, claiming a 69% reduction in scope 1 and 2 emissions since 2021.

But the core issue’s still staring them in the face: supply can’t meet demand. And that’s not sustainable. The demand spike is great, don’t get us wrong, but growth only works when you can fulfill it without burning out your system.

People Are Buying Warhammer for the Merch Now

You don’t need to show up to a store with a measuring tape and a tray of dice anymore. You can rep your favorite faction on a hoodie, binge the lore, or grab a badass statue.

That shift is changing how GW earns money, and they’re leaning into it, hard.

Risk? Oh, There’s Plenty

- IP theft

- Cybersecurity threats

- Supply chain instability

- Tariffs in the US (up to £12 million hit for next year’s finances)

On top of that, their massive IT overhaul won’t be done until 2028/29. That’s a long time to be flying with legacy systems.

And let’s be honest, they’re not fighting for your wallet anymore, they’re fighting for your time. The hobby’s not just competing with other wargames.

It’s competing with Netflix, Diablo, Baldur’s Gate, or that stack of shame from Steam.

Final Thoughts From Us

Production can’t keep up. Paint shortages and out-of-stock kits are frustrating diehards and pushing curious newcomers away.

The cash is flowing now, but cash only matters if you can convert it into experience. And that starts with making sure we can actually buy the stuff we want, when we want it.

Until then, we’ll just keep hitting “refresh” from here…

GW’s CEO Gets Tons of “Free” Stock